Description

Automate the Strategy Building Process

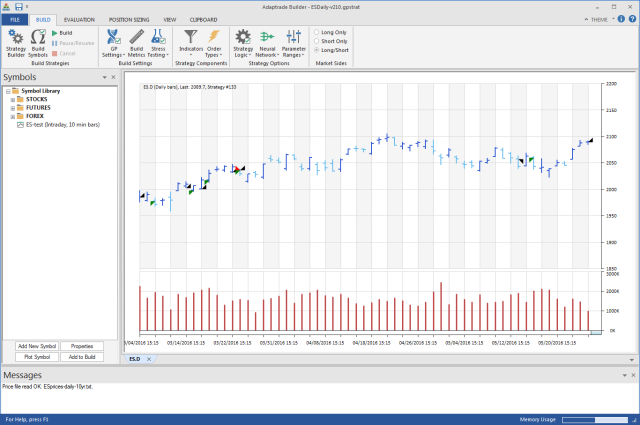

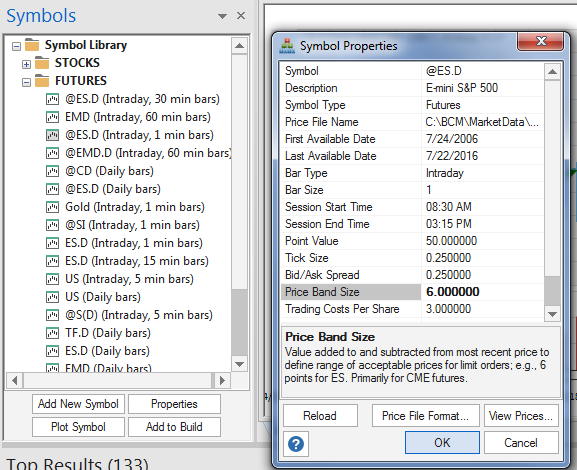

Adaptrade Builder is the next generation of systematic trading tools. Builder can discover, code, and test thousands of unique and complete trading strategies in minutes for stocks, futures, forex, ETFs, and other markets on time intervals from tick data to monthly bars. Adaptrade Builder is the quick and easy way to develop custom trading strategies for TradeStation, MultiCharts, NinjaTrader 7, MetaTrader 4, and AmiBroker. Recently added features: multiple data series, optional neural network entry conditions, adaptive and zero-lag indicators, finding the optimal intraday bar size. Costs less than a single trading strategy.

How does it work?

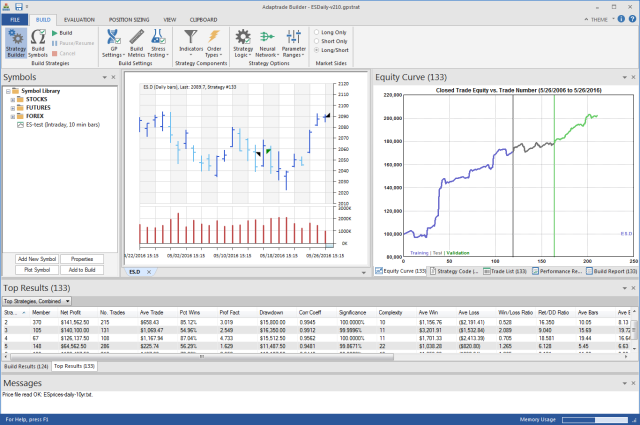

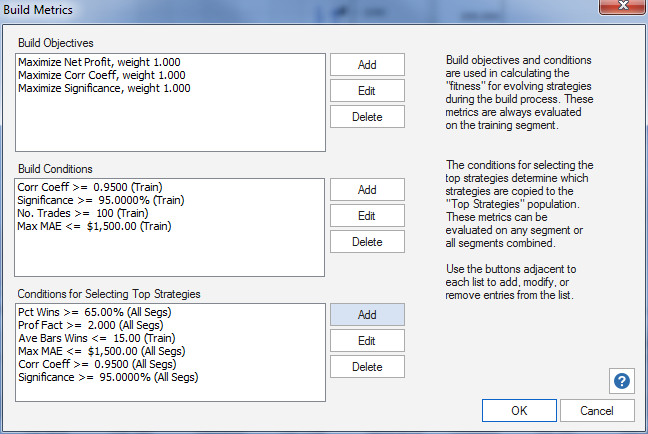

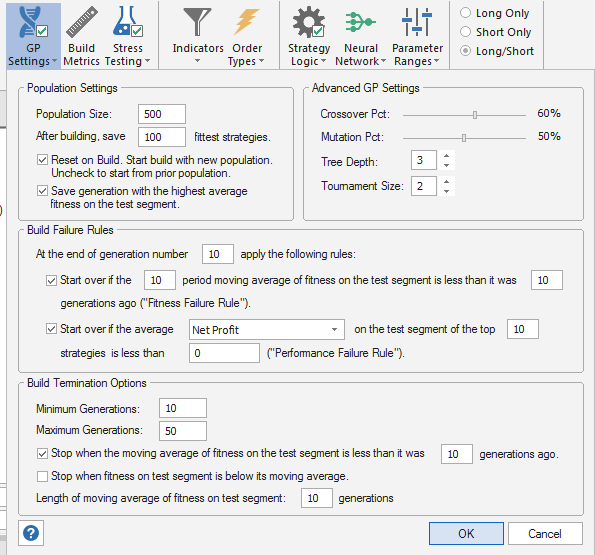

As an example, let’s say you want a trading strategy for a small portfolio of stocks – it could just as well be futures, forex or other instruments – and that you want your strategy to have a profit factor greater than 2, no more than 20% drawdown, and a nice straight equity curve. You want winning trades to last, say, five days on average. To have Builder generate such a strategy, you would load the price data for the symbols of interest; enter your requirements for profit factor, drawdown, correlation coefficient, and average bars in wins; then press the Build button. Builder will use an advanced genetic programming algorithm – a type of artificial intelligence (AI) – to evolve your strategy while you watch. When it’s finished, you can review the performance results and strategy code and either accept it as is or modify one of the settings and build again.

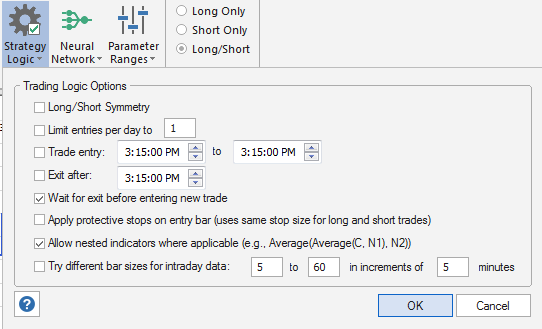

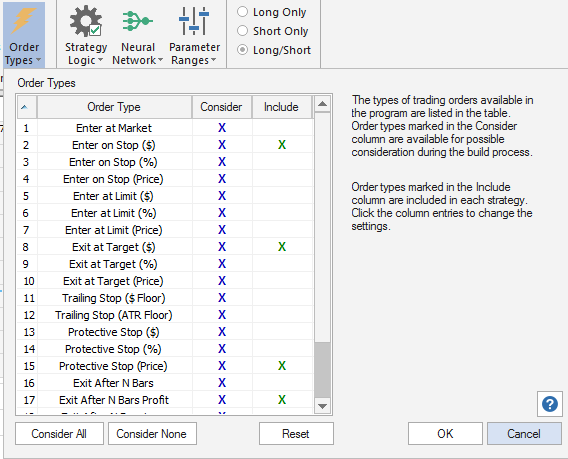

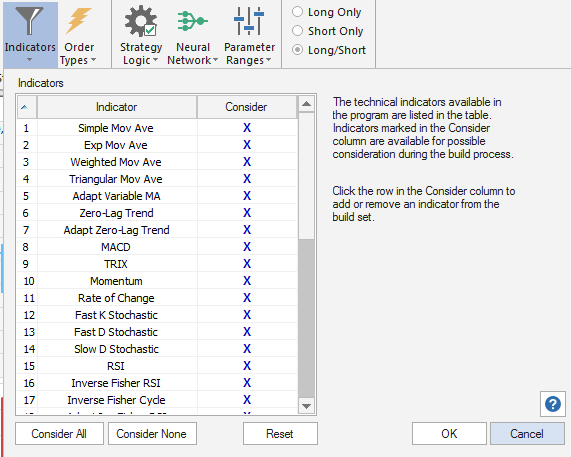

Builder has a variety of settings that allow you to customize the results, such as specifying the types of trading orders used for entry and exit, the set of indicators that can be considered for use in the strategies, and whether the strategies are long-only, short-only, or include both long and short trades. You can also specify the range of available values used for indicator inputs and order price calculations. Other options let you limit the number of entries per day and specify the entry and exit times for intraday strategies. You can also add a neural network as an entry condition, control the strategy complexity to limit the risk of over-fitting, and specify how much data is set aside for out-of-sample testing.

What Do Others Say About Adaptrade Builder?

- “..I can’t say enough about this software. I’ve been using it now religiously for the past 7 months with very positive results. This software is truly ahead of the curve and the more I use it, the more I appreciate it. ..Thanks again for introducing such a revolutionary concept into the market!”

R. S., Toronto, Canada

- “I’m surprised how fast it is, I thought I have to run it overnight to get a strategy… I use an I7 2,8 GH and a run lasts only some minutes. … Builder; exceeds all my expectations.”

W. S., Berg, Germany

- “Just wanted to let you know that I think the builder software is a very worthwhile, awesome tool. It is easy to use and it gives very nice equity curves. I have enjoyed using it very much.”

R. W., Eugene, OR

- “First off I wanted to say how helpful Builder has been to me. I have been using it for a couple of years (with tradestation) and nearly all of the strategies have been profitable in real life.”

J. W., Sevenoaks, UK

- “Just purchased your software and ran the first build on 120 min gold futures 2001-2009. Out of sample had a higher PF than in sample. …Very nice. Thanks.”

R. D., Stephens City, VA

- “…wanted to drop you a note and let you know that the AdaptiveIRSI has proven to be a great piece of code in trading the DAX. I trade in the shorter time frame (1-3 days), and have found this function to be an excellent confirming pattern when coupled with my strategies.”

R. W., London, UK

- “Great last couple weeks trading Builder systems on gold futures by the way!”

C. D., Palo Alto, CA

Why not build strategies yourself?

Developing an effective trading strategy the traditional way is not easy. Whether you do your own programming or hire someone else to implement your ideas, the development process is complicated and time consuming. Assuming you have a viable idea to start with, the first step is programming it and verifying that the code does what you want it to do. You then need to test it to see if it has potential. Unfortunately, most trading ideas simply don’t work, which means more programming, more testing, and so on.

Many traders abandon the idea of developing their own strategy and opt to purchase one. While this can be effective, the drawbacks of this option include the fact that most trading systems are developed for a small number of markets and/or time frames (e.g., daily bars only). If you decide to trade a different market or time frame, you need to purchase another system. Also, markets can and do change over time, and even the best systems sometimes need re-optimization and/or modifications at some point in the future, which makes the initial investment in the system less cost-effective.

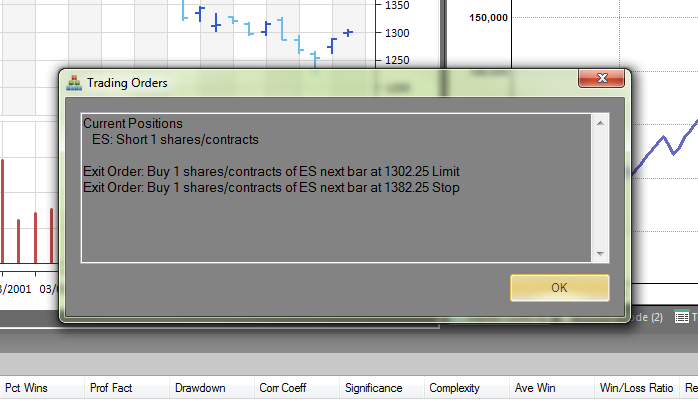

Adaptrade Builder was designed to address these problems. Builder automates the strategy development process. It outputs clean, complete code that includes rules and trading orders for entering the market, exiting at a profit, and exiting at a loss (e.g., money management stops). The strategy code is provided in open text file format for each supported platform.

How do you know the strategies will be profitable?

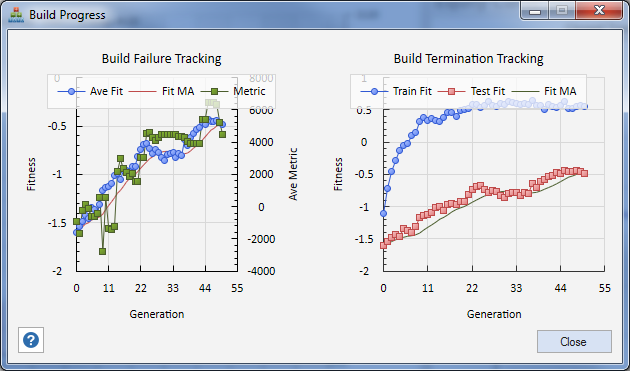

No one can guarantee that a trading strategy will be profitable. However, Builder is designed with features that give you the best possible chance of developing robust, profitable trading strategies. Builder incorporates several features that help guide the process to strategies that are likely to have good out-of-sample and real-time performance. In particular, you can separate the data on which the strategies are built (“training” data) from the data used for testing (“testing” and “validation” data).

Also, you can build strategies that maximize or minimize any combination of more than 100 different performance metrics, including ones related to strategy quality and robustness, such as significance, correlation coefficient of the equity curve, Kelly f value, MAR ratio, Sortino ratio, profit factor, and system complexity. Moreover, the strategy logic produced by Builder incorporates volatility-normalized parameters, which help adapt the strategies to different market conditions. The user’s guide includes a section that covers factors affecting out-of-sample performance and ways to maximize the out-of-sample and real-time trading results.

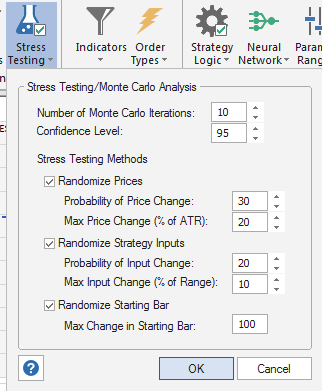

The latest version of Builder also includes special build tracking rules that monitor the build process and either restart or terminate when the results start to become over-fit. To minimize the chances of over-fitting, you can incorporate stress testing options that make the strategies less sensitive to variations in the input parameter values and market prices. After the strategies are built, a unique test of statistical significance can be run to verify that the strategy’s positive performance is not simply a result of good luck .

Your purchase of Builder includes:

- Lifetime per-user license for the program.

- Free upgrades for one year from the date of purchase.

- Three example files to demonstrate different settings that might be used in Builder and the kind of strategy code that may result.

- Six new bonus strategies . These strategies, developed using Builder version 2, include strategies for 3 min bars and daily bars of the E-mini S&P 500, 60 min bars of the mini Russell 2000 futures, daily bars of Amazon, 15 min bars of Google, and 60 min bars of EURUSD. In addition, seven bonus strategies developed using Builder version 1 are also included. These bonus strategies are only available to licensed users of the program.

- A 30 day money back guarantee.

The software is designed for both individual and professional traders. The familiar Windows interface makes the program easy to use, and detailed help files are available if needed to explain how to use the program. To get started, all you need is TradeStation, MultiCharts, NinjaTrader, MetaTrader 4, or AmiBroker. If you trade only on end-of-day data and can place trading orders manually through your broker, then you can use Builder as a stand-alone trading platform without the need for one of the supported platforms.

Reviews

There are no reviews yet.